In 2025, taking your small-scale business global is more accessible than ever. Thanks to improved digital platforms, simplified rules, and government schemes, even home-based entrepreneurs can reach international buyers.

This detailed article walks you through each phase of the export process—from official documentation to receiving payments from clients abroad.

- Step 1: Company Registration

- Step 2: Get an Import Export Code (IEC)

- Step 3: Select the Right Products for Export

- Step 4: Research High-Potential International Markets

- Step 5: Understand the HS Code System

- Step 6: Gather All Necessary Export Documentation

- Step 7: Plan Shipping and Delivery Methods

- Step 8: Comply with GST and Leverage Government Incentives

- Step 9: Ensure Safe Payment from Overseas Clients

- Step 10: Become a Member of Export Promotion Councils

- Step 11: Create a Digital Export Brand

- Step 12: Apply for Export Loans and Insurance

- Step 13: Work with Merchant Exporters

- Frequently Asked Questions (FAQs)

- 1. Can individual business owners export from India?

- 2. Is having an IEC a legal requirement?

- 3. What’s the initial cost to begin exporting?

- 4. Is GST compulsory for exporters?

- 5. Which items will be popular in 2025?

- 6. How do I find international buyers?

- 7. Can online marketplaces like Amazon support exports?

- 8. What does ECGC insurance offer?

- Conclusion

Step 1: Company Registration

Your business must be officially registered to begin exporting.

Basic Requirements:

- PAN (Permanent Account Number)

- MSME/Udyam registration (udyamregistration.gov.in)

- Business bank account in the name of the firm

Step 2: Get an Import Export Code (IEC)

The IEC is a 10-digit code needed to conduct any export-related transaction.

Application Process:

- Register at dgft.gov.in

- Upload necessary documents and pay ₹500

- Receive your code typically within 1–2 days

Step 3: Select the Right Products for Export

Choose products that are in global demand and practical to ship.

Tips:

- Focus on categories like organic food, handmade crafts, eco-products, or garments

- Use online tools such as the Indian Trade Portal or ITC Trade Map

- Be aware of packaging, shipping regulations, and durability

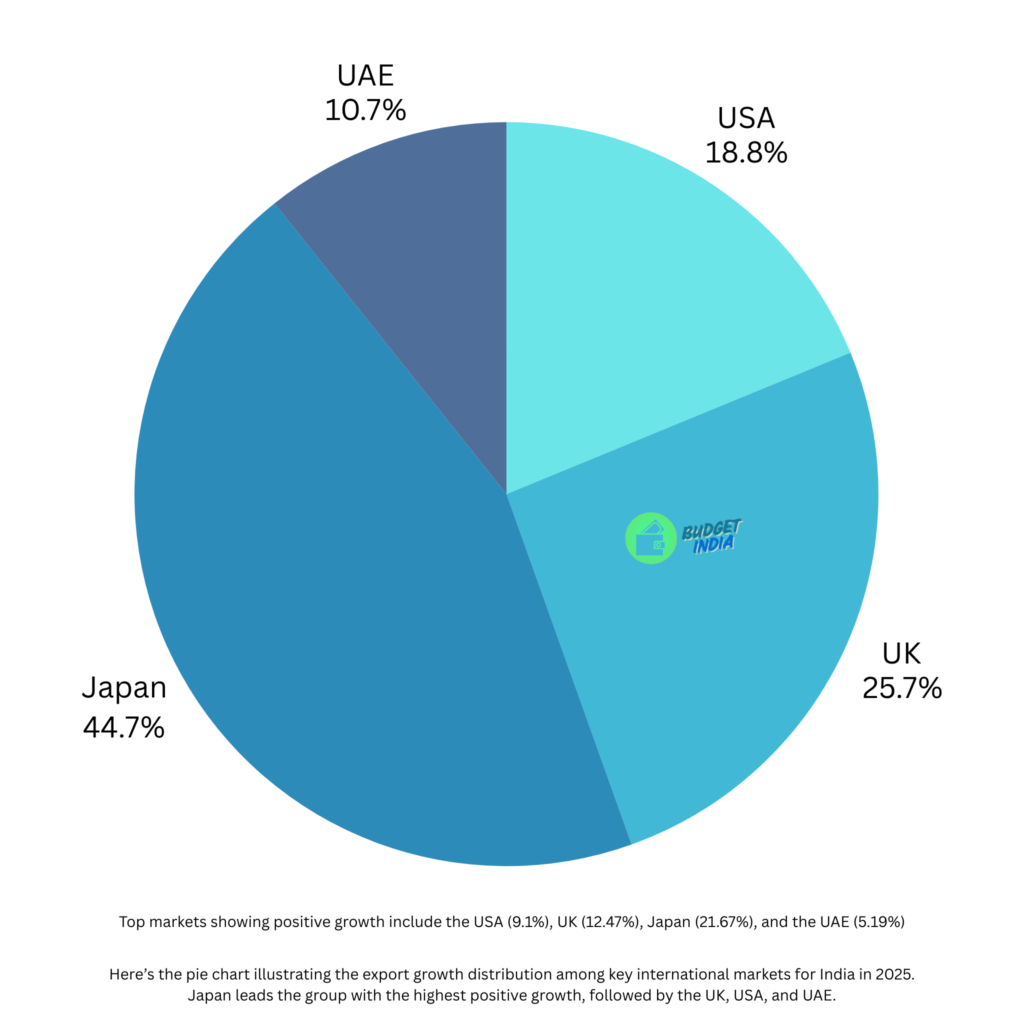

Step 4: Research High-Potential International Markets

Picking the right countries to export to can impact your profits.

How to Evaluate:

- Research using B2B websites and government portals

- Begin with trade-friendly nations

- Factor in freight charges, import laws, and market competition

Step 5: Understand the HS Code System

HS (Harmonized System) codes help classify goods for customs.

Importance:

- Needed for filing customs paperwork

- Influences taxes and export subsidies

Look up relevant HS Codes on the DGFT or related council websites.

Step 6: Gather All Necessary Export Documentation

Accurate paperwork is vital for legal compliance and payment clearance.

Common Documents:

- Invoice and Packing List

- Bill of Lading or Airway Bill

- Origin Certificate

- Shipping Bill

- Insurance papers

Step 7: Plan Shipping and Delivery Methods

Choose a suitable logistics plan based on your shipment size and urgency.

Transportation Tips:

- Decide between air and sea based on budget and timelines

- Hire a CHA (Customs House Agent) for compliance

- Work with recognized shipping firms like DHL, Maersk, or India Post

Step 8: Comply with GST and Leverage Government Incentives

Exports fall under zero-rated supplies, but GST registration is mandatory.

Options:

- Use LUT to avoid paying IGST

- Or pay IGST and apply for refunds

Popular Schemes:

- RoDTEP (Refund of Duties and Taxes)

- Interest subsidy schemes

- Export duty drawbacks

Step 9: Ensure Safe Payment from Overseas Clients

Use secure channels to avoid payment delays or defaults.

Accepted Payment Modes:

- Prepayment

- Letter of Credit (LC)

- Documents Against Payment (DP)

- Open account (only for trusted clients)

Choose banks familiar with international transactions.

Step 10: Become a Member of Export Promotion Councils

These bodies help exporters with market data, trade leads, and event participation.

Notable Councils:

- FIEO

- APEDA (for agricultural goods)

- EPCH (for handicrafts)

Step 11: Create a Digital Export Brand

Online platforms are powerful tools to attract global clients.

What to Do:

- Build a website featuring your products

- List on global portals like Alibaba or Indiamart

- Use SEO and online ads to boost visibility

Step 12: Apply for Export Loans and Insurance

Financial and risk support strengthens your export operations.

Funding Options:

- Get export credits from EXIM Bank, SIDBI, etc.

- Buy ECGC policies to protect against non-payment or political risks

Step 13: Work with Merchant Exporters

If you’re new to exporting, merchant exporters can simplify the process.

Perks:

- Lesser paperwork

- Ready buyer network

- Quicker entry into foreign trade

Frequently Asked Questions (FAQs)

1. Can individual business owners export from India?

Yes, and registering as an MSME offers added advantages.

2. Is having an IEC a legal requirement?

Yes, it is mandatory for any export activity.

3. What’s the initial cost to begin exporting?

You can start with as little as ₹50,000, depending on product and shipping.

4. Is GST compulsory for exporters?

Yes, although exports are tax-exempt, registration is required.

5. Which items will be popular in 2025?

Expect demand in organic goods, eco-friendly products, ethnic fashion, and herbal cosmetics.

6. How do I find international buyers?

Use trade directories, virtual expos, and contact Indian embassies abroad.

7. Can online marketplaces like Amazon support exports?

Yes. Platforms like Amazon Global and Etsy offer global sales opportunities.

8. What does ECGC insurance offer?

Protection against buyer defaults and political uncertainties.

Conclusion

With the evolving global economy and India’s export support systems, 2025 presents a promising environment for small businesses to grow globally. Follow the steps outlined here to confidently launch your export business.

Begin small, stay consistent, and grow your brand internationally—one shipment at a time.

Please Refer to official Website: https://www.indiantradeportal.in/vs.jsp?lang=0&id=0,25,44

Leave a Reply