Investing in Mutual Funds for a period of five years or more is a proven strategy for substantial wealth accumulation. This long-term approach harnesses the power of compounding, reduces the impact of market volatility, and supports critical financial goals such as:

- Building a retirement corpus

- Purchasing real estate or property

- Funding children’s higher education or marriage

- Attaining financial independence

1. Why Choose Mutual Funds for Prolonged Wealth Goals

Mutual funds are managed by financial experts, deliver broad market exposure, and are available across various risk-return profiles. Key benefits include:

- Professional portfolio oversight

- Asset diversification across multiple sectors

- Custom investment solutions for specific life goals

- Tax-saving options through instruments like ELSS

As India’s financial ecosystem continues to evolve in 2025, mutual funds remain a reliable route for building long-term capital.

Top 10 Mutual Funds for Extended Investment in 2025

2.1 Parag Parikh Flexi Cap Fund

Category: Flexi Cap

5-Year CAGR: Approx. 15.3%

Assets Under Management (AUM): ₹45,000+ Crore

Expense Ratio (Direct): ~0.74%

Key Features:

- Invests across Indian and global equities (including firms such as Amazon and Alphabet)

- Focuses on undervalued yet fundamentally strong enterprises

- Lower volatility relative to peers

Ideal For:

Moderate-risk investors seeking global exposure and long-term capital preservation with growth.

2.2 Mirae Asset Emerging Bluechip Fund

Category: Large & Mid Cap

5-Year Return: Approx. 17%

AUM: ₹32,000+ Crore

Expense Ratio: ~0.66%

Core Strengths:

- Blends the resilience of large-cap companies with the expansion potential of mid-caps

- Prioritizes enterprises with competent management and futuristic business models

- Outperforms standard benchmarks consistently

Recommended For:

Investors targeting elevated returns with medium volatility over the long run.

2.3 Axis Bluechip Fund

Segment: Large Cap

5-Year Growth: Approx. 12.5%

AUM: ₹35,000+ Crore

Expense Rate: ~0.51%

Advantages:

- Emphasizes investments in India’s most stable corporations

- Strong corporate governance and consistent earnings

- Suitable for conservative investment strategies

Best Suited For:

Risk-averse investors seeking dependable growth with minimal deviation.

2.4 SBI Small Cap Fund

Type: Small Cap

5-Year CAGR: Approx. 20%

AUM: ₹20,000+ Crore

Expense Ratio: ~0.89%

Key Attributes:

- Targets emerging and high-potential businesses

- Thorough research and stock selection process

- Potential for significant wealth creation over the long term

Preferred By:

Aggressive investors with a 7–10 year horizon and tolerance for market swings.

2.5 HDFC Flexi Cap Fund

Category: Flexi Cap

5-Year Yield: Approx. 14%

AUM: ₹32,000+ Crore

Expense Rate: ~0.95%

Distinct Traits:

- Diversifies across large, mid, and small-cap stocks

- Balances risk and growth potential

- Reacts dynamically to market trends

Ideal For:

Investors seeking adaptability and consistent returns through varied market cycles.

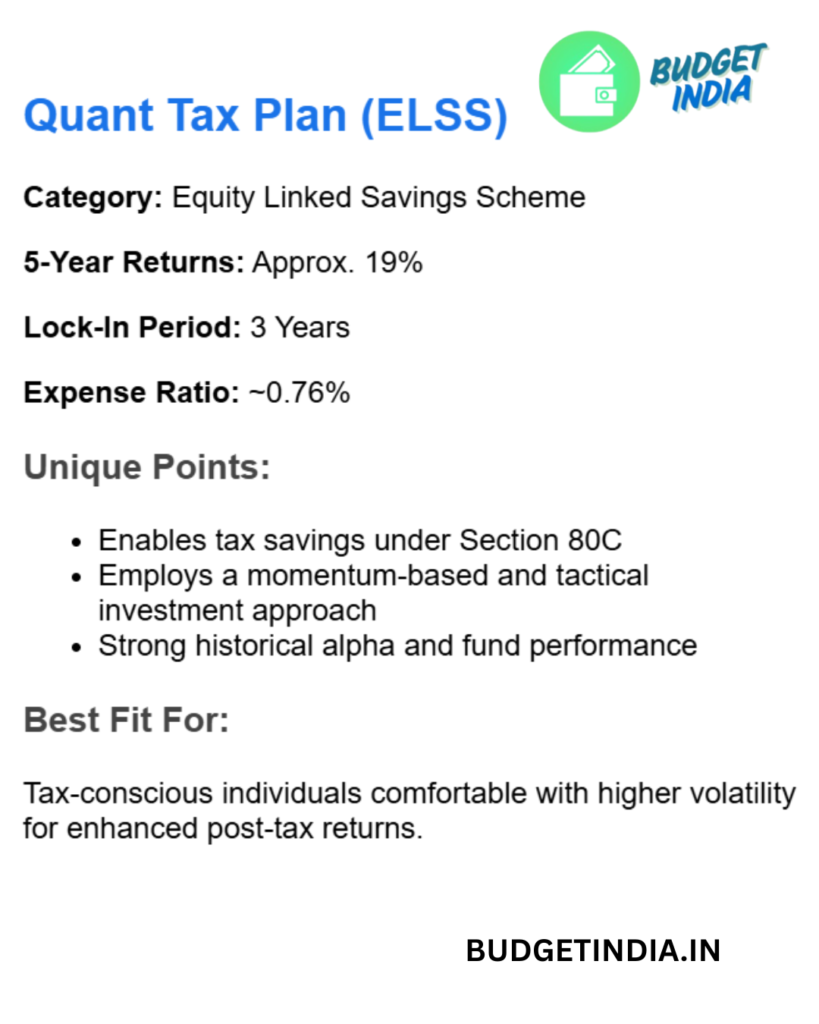

2.6 Quant Tax Plan (ELSS)

Category: Equity Linked Savings Scheme

5-Year Returns: Approx. 19%

Lock-In Period: 3 Years

Expense Ratio: ~0.76%

Unique Points:

- Enables tax savings under Section 80C

- Employs a momentum-based and tactical investment approach

- Strong historical alpha and fund performance

Best Fit For:

Tax-conscious individuals comfortable with higher volatility for enhanced post-tax returns.

2.7 Kotak Emerging Equity Fund

Type: Mid Cap

5-Year Growth: Approx. 16%

AUM: ₹28,000+ Crore

Expense Ratio: ~0.71%

Notable Strengths:

- Focuses on future market leaders in the mid-cap segment

- Maintains balanced diversification

- Historically steady across different economic phases

Ideal Investors:

Individuals looking for growth potential with moderate risk exposure.

2.8 HDFC Balanced Advantage Fund

Type: Hybrid – Dynamic Asset Allocation

5-Year Performance: Approx. 11%

Fund Size: ₹58,000+ Crore

Expense Ratio: ~0.97%

Key Characteristics:

- Automatically rebalances between equity and debt based on market conditions

- Reduces downside risk

- Facilitates stable wealth development

Perfect For:

Risk-averse investors seeking predictable returns and capital protection.

2.9 ICICI Prudential Bluechip Fund

Type: Large Cap

5-Year Returns: Approx. 13%

Assets: ₹40,000+ Crore

Expense Rate: ~0.65%

Benefits:

- Invests in industry-dominant, financially sound businesses

- Consistent track record

- Excellent as a foundational component of a diversified portfolio

Target Audience:

Conservative investors desiring steady equity exposure with limited volatility.

2.10 Nippon India Small Cap Fund

Segment: Small Cap

5-Year CAGR: Approx. 21%

AUM: ₹38,000+ Crore

Expense Rate: ~0.80%

Core Highlights:

- Concentrates on rapidly expanding small-cap companies

- Offers high capital growth potential over time

- Led by a seasoned fund management team

Suited For:

Experienced investors willing to accept near-term fluctuations for long-term appreciation.

Conclusion

Long-term investing requires vision, discipline, and patience. Selecting mutual funds that align with your risk tolerance and financial aspirations is essential for building a solid wealth foundation.

- Begin early

- Maintain consistency

- Monitor and rebalance

- Allow compounding to work over time

The most sustainable wealth is cultivated steadily—not rapidly—through strategic decisions and unwavering commitment.

Frequently Asked Questions (FAQs)

- What defines a long-term mutual fund investment?

Typically, any investment held for five or more years qualifies as long-term. This timeframe allows the investor to benefit from compounding and navigate market volatility effectively.

2. Which is more advisable: SIP or Lump Sum?

- SIP (Systematic Investment Plan): Recommended for consistent investing and market averaging.

- Lump Sum: Suitable when deploying large amounts during favorable market conditions.

3. Are small-cap funds suitable for prolonged investments?

Yes, albeit with caution. Small-cap funds may exhibit higher short-term risk, but their long-term growth prospects are often substantial for investors with extended investment periods.

4. How frequently should I assess my portfolio?

Annual reviews are typically adequate. Focus on performance comparison, portfolio alignment with life goals, and fund consistency.

5. Do mutual funds provide tax advantages?

Yes. ELSS funds qualify for deductions up

Leave a Reply