In India’s evolving financial environment of 2025, personal loan continue to serve as a practical solution for immediate financial requirements. Whether you’re planning a lavish wedding, facing sudden medical bills, organizing an international vacation, funding higher education, or consolidating existing debt, personal loans provide fast access to funds without needing to offer any collateral. The key determinant of the loan’s cost remains the interest rate.

A comparative evaluation of personal loan interest rates in India in 2025 is essential for every borrower. These rates have a direct effect on the monthly EMIs and the overall repayment burden. This article provides a detailed overview of interest rates offered by top banks and NBFCs, factors influencing these rates, and tips on securing the most favorable terms. It also explores the differences between fixed and floating interest structures.

- What is a Personal Loan?

- Why Comparing Personal Loan Interest Rates Matters in 2025

- Key Factors Affecting Personal Loan Interest Rates in 2025

- Personal Loan Interest Rate Table – India 2025

- Fixed vs Floating Interest Rates in 2025

- Tips to Secure the Best Personal Loan in 2025

- Recommended Lenders Based on Borrower Type

- Role of RBI in Loan Rate Movements in 2025

- Growth of Digital Lending and Fintech in 2025

- EMI Example for Rs. 5 Lakh Loan over 5 Years

- Conclusion

- FAQs

What is a Personal Loan?

A personal loan is an unsecured credit facility offered by banks, NBFCs, and digital lenders based on the borrower’s creditworthiness, income level, and repayment history. Since no security is required, lenders rely on indicators such as credit score, income stability, and employment background.

Common Purposes for Personal Loans:

- Medical emergencies

- Wedding expenses

- Travel and holidays

- Home improvement

- Educational needs

- Debt consolidation

- Purchasing electronics or appliances

These loans are typically sanctioned quickly, with disbursal timelines ranging from a few hours to a few days. Loan amounts usually range between Rs. 10,000 and Rs. 40 lakhs, with repayment tenures from 12 to 84 months.

Why Comparing Personal Loan Interest Rates Matters in 2025

With a surge in competition from fintech players and digital lenders alongside traditional banks, the personal loan market in India has diversified. Each lender offers different rates, making comparison essential to choose the most cost-effective option.

Even a small difference of 1% in interest rate can result in significant savings over the loan period. For example, a Rs. 5 lakh loan over five years at 11% interest compared to 12% can reduce total costs by several thousand rupees.

Key Factors Affecting Personal Loan Interest Rates in 2025

1. Credit Score

Applicants with a CIBIL score above 750 are more likely to secure lower interest rates.

2. Income Level

A stable and high income reduces the risk for lenders and often results in better loan terms.

3. Employment Type

Government employees and those working with reputed private organizations typically receive more competitive rates. Self-employed professionals may be charged higher unless supported by solid financial documentation.

4. Existing Banking Relationship

Customers with long-standing relationships—such as having savings accounts or FDs—with a lender may get preferential rates.

5. Loan Tenure

Shorter durations often attract lower rates, whereas longer tenures may incur higher interest.

6. Loan Amount

Larger loan amounts may carry a marginal premium in interest, unless offset by strong financial credentials.

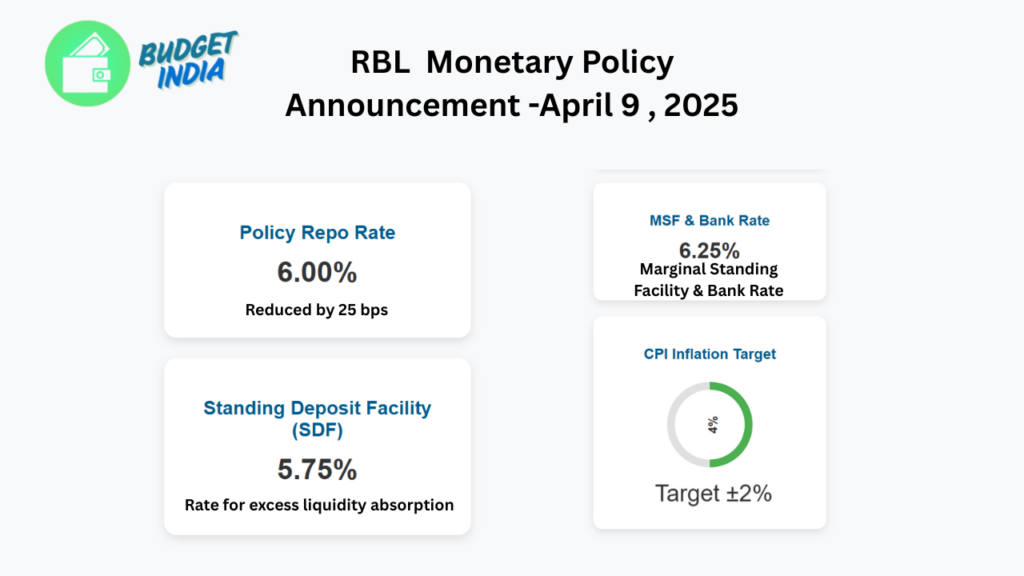

7. RBI Policy Rates

The Reserve Bank of India’s repo rate decisions influence personal loan rates. A hike typically raises rates, while a cut can lead to more affordable offers.

NOTE : The RBI, in its monetary policy announcement on April 9, 2025, reduced the policy repo rate by 25 basis points to 6.00%. Consequently, SDF stands at 5.75%, and MSF and the Bank Rate at 6.25%. This decision aims to achieve the CPI inflation target of 4% (+/- 2%) while supporting growth

Personal Loan Interest Rate Table – India 2025

| Lender | Interest Rate (p.a.) | Loan Amount Range | Repayment Tenure | Processing Fee |

|---|---|---|---|---|

| HDFC Bank | 10.50% – 21.00% | Rs. 50,000 – Rs. 40 lakh | Up to 6 years | Up to 2.5% of the sanctioned amount |

| ICICI Bank | 10.75% – 20.00% | Rs. 50,000 – Rs. 25 lakh | Up to 5 years | Up to 2.5% |

| SBI | 11.15% – 15.30% | Rs. 24,000 – Rs. 20 lakh | Up to 6 years | 1.50% (Min Rs. 1,000, Max Rs. 15,000) |

| Axis Bank | 10.99% – 21.00% | Rs. 50,000 – Rs. 25 lakh | Up to 5 years | 1.5% – 2% |

| Kotak Mahindra Bank | 10.99% – 24.00% | Rs. 50,000 – Rs. 25 lakh | 1 – 5 years | Up to 2.5% |

| Bajaj Finserv | 11.00% – 25.00% | Rs. 30,000 – Rs. 40 lakh | 1 – 7 years | Up to 4% |

| Tata Capital | 10.99% – 24.00% | Rs. 75,000 – Rs. 35 lakh | 1 – 6 years | Up to 2.75% |

| IDFC FIRST Bank | 10.49% – 23.00% | Rs. 20,000 – Rs. 40 lakh | Up to 5 years | 1% – 2% |

| PNB | 11.40% – 16.95% | Rs. 50,000 – Rs. 10 lakh | Up to 5 years | 1% (Max Rs. 10,000) |

| Bank of Baroda | 10.90% – 16.00% | Rs. 50,000 – Rs. 20 lakh | Up to 7 years | Up to 2% |

Fixed vs Floating Interest Rates in 2025

| Aspect | Fixed Rate | Floating Rate |

| Rate Consistency | Unchanged throughout tenure | Varies with market trends |

| EMI Planning | Stable EMIs | EMIs may increase or decrease |

| During Rate Hikes | More economical | May lead to higher payments |

| During Rate Cuts | Less advantageous | Enables savings |

| Flexibility | Rigid | Adapts to economic changes |

Tips to Secure the Best Personal Loan in 2025

- Build a Strong Credit Profile – Aim for a score of 750+ to qualify for better rates.

- Compare Offers Online – Use aggregator websites to view and compare various lenders.

- Consider Pre-Approved Loans – Often carry lower rates and minimal documentation.

- Negotiate Fees – Long-time bank customers can request waivers or discounts.

- Choose Short Tenures – Shorter periods reduce the total interest outgo.

- Decline Unnecessary Add-ons – Avoid bundling insurance unless essential.

- Apply Digitally – Online applications may unlock special interest rate deals.

Recommended Lenders Based on Borrower Type

| Borrower Category | Recommended Institutions |

| Government Employees | SBI, PNB |

| Private Sector Employees | HDFC Bank, ICICI Bank, Axis Bank |

| Self-Employed/Business Owners | Bajaj Finserv, IDFC FIRST Bank, Tata Capital |

| Excellent Credit Score | IDFC FIRST Bank, Kotak Mahindra Bank |

| High Loan Requirements | HDFC Bank, Bajaj Finserv, ICICI Bank |

Role of RBI in Loan Rate Movements in 2025

The RBI’s repo rate adjustments continue to steer lending rates. When the repo rate rises, borrowing becomes more expensive as lenders adjust their offerings. A rate cut by the RBI, on the other hand, often triggers competitive loan offers. Keeping track of these changes can help borrowers time their applications strategically.

Growth of Digital Lending and Fintech in 2025

Fintech companies are reshaping personal loan accessibility. Innovations like AI-based risk assessment, instant e-KYC, and paperless disbursals have simplified the borrowing journey.

Leading digital lenders include:

- Cred

- KreditBee

- MoneyTap

- CASHe

- NIRA

- PaySense

While these platforms offer fast services, interest rates may be higher for applicants with lower credit ratings. A comparison with traditional lenders is always advisable.

EMI Example for Rs. 5 Lakh Loan over 5 Years

| Interest Rate | Monthly EMI | Total Interest | Total Payable |

| 10% | Rs. 10,624 | Rs. 1,37,440 | Rs. 6,37,440 |

| 12% | Rs. 11,122 | Rs. 1,67,320 | Rs. 6,67,320 |

| 14% | Rs. 11,621 | Rs. 1,97,260 | Rs. 6,97,260 |

Just a 2% rise in interest can lead to an additional cost of nearly Rs. 30,000.

Conclusion

Interest rates are the central aspect of evaluating personal loan options in India in 2025. Yet, other factors like processing fees, service reliability, tenure options, and hidden costs also play a crucial role.

Given the wide array of lenders catering to various profiles, thorough research and careful selection help ensure a financially sound borrowing experience.

Always use reliable EMI calculators, scrutinize loan agreements carefully, and consider professional financial advice when making personal loan decisions.

FAQs

1. What is a good credit score for personal loans in 2025?

A score above 750 is ideal, though some lenders accept lower scores with higher interest.

2. Can I get a loan without income proof?

In rare cases like pre-approved offers or high-value bank relationships, it’s possible.

3. Are interest rates fixed for the full loan term?

Loans can have fixed or floating rates depending on the lender.

4. What are typical personal loan processing fees?

Generally range from 0.5% to 4% of the sanctioned amount.

5. Are prepayment charges applicable in 2025?

Yes, usually between 2% and 5%, though some lenders waive them during offers.

6. Which lenders disburse loans the fastest?

HDFC Bank, ICICI Bank, and Bajaj Finserv are known for rapid loan approvals.

Leave a Reply